KEY POINTS

- Currently, individuals can transfer up to $11.7 million to heirs without facing the federal estate or gift tax.

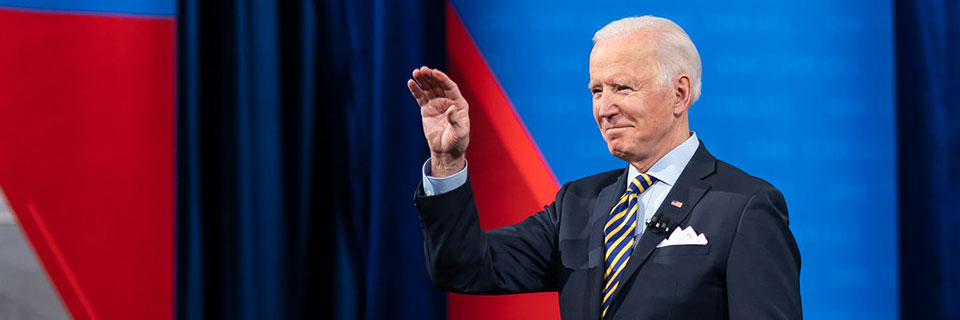

- President-elect Joe Biden could call for reducing this exemption to $3.5 million for estates and $1 million for gifts.

- Lawmakers will likely be focused on pandemic relief this year, which can buy wealthy families more time for estate planning and asset transfers.

Wealthy Americans worried about the prospect of higher estate and gift taxes might have more time to come up with a strategy.

Biden has repeatedly suggested that wealthy Americans are not paying their “fair share” of taxes. He has indicated that he plans to reduce the tax exemption for estates and gifts and increase the rates at which they are taxed to “historic norms.”

That could mean reducing the amount an individual can transfer free of estate tax to $3.5 million, lowering the lifetime exemption for gifts to $1 million and raising the tax rate on transfers over those amounts to 45%.

Currently, individuals have a unified $11.7 million estate and gift exemption. Transfers exceeding that amount are subject to a top tax rate of 40%.

These generous terms are set to expire at the end of 2025.

“The higher exemption and the lower tax rates will not last forever,” said Dustin Stamper, managing director of Grant Thornton’s national tax office.

Wealthy families may still have time to revisit their estate plans — and do so under today’s friendly terms.

In other words, the window to use the huge exemption to avoid estate taxes may remain open for another year...

Login to see the whole story

For business consultation, please contact us