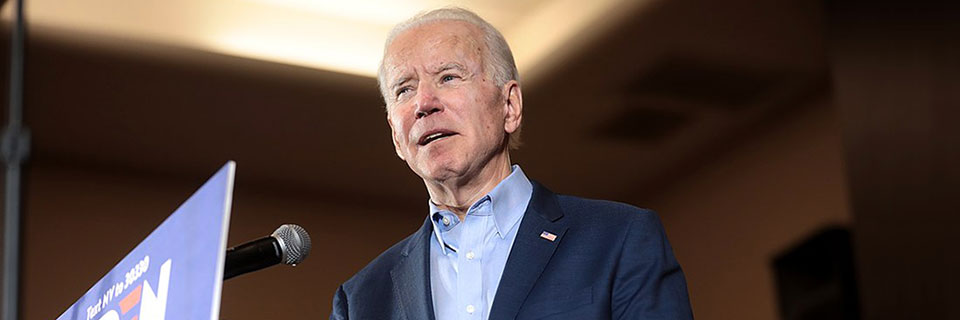

A Joe Biden presidency will potentially impact the personal finances of millions of Americans, from how much they pay in income taxes to whether they can pare college debt – or afford college at all.

Those who stand to benefit most are the middle class and low-wage earners, experts say, while the affluent will likely pay more.

"Biden ramps up government spending on education, health care and other social programs, the benefits of which largely go to those in the bottom half of the income distribution,'' Moody's Analytics wrote in a report for investors before Biden was officially the president-elect. "Meanwhile, he meaningfully increases taxes on the well-to-do, financial institutions and businesses to help pay for it."

Here's what we might expect from Biden over the next four years:

Taxes

Biden has repeatedly said that Americans earning less than $400,000 a year won’t pay a cent more in taxes. But those earning above that threshold will lose their tax cuts and likely pay a bit more.

Biden has recommended raising the marginal income tax rate from 37% to 39.6% for the nation's highest pool of earners, according to The Tax Foundation and the Committee for a Responsible Federal Budget.

Americans with more than $1 million in total income would see income brought in from dividends, as well as capital gains, taxed like their wages, and pare the itemized deductions taxpayers could declare, Moody's says.

Meanwhile, Biden campaign spokesman Michael Gwin has told Reuters that Biden will effectively lower taxes for the middle class by giving them refundable credits that reduce what they pay for health care coverage and help them to purchase their first home and pay for child care.

Most immediately, to deal with the economic crisis that has erased millions of jobs and left many Americans struggling to pay their bills, Biden says he will expand the Child Tax Credit to $3,000 for each child ages 6 to 17, and $3,600 for the youngest children. That would mean according to his website that a teacher and electrician with a baby and middle schooler would receive $6,600.

Health care

The Affordable Care Act, which provides health care for millions of Americans, hangs in the balance with the U.S. Supreme Court set to weigh in on Nov. 10 on a lawsuit brought by several Republican-led states and the Trump administration to abolish the ACA.

But Biden has a plan for not only salvaging the law but making it stronger. "What I’m going to do is pass Obamacare with a public option,'' Biden said in the final presidential debate against President Donald Trump. "It becomes Bidencare." ...

.

For business consultation, please contact us